iowa inheritance tax rates 2021

The Iowa inheritance tax rate varies depending on their relationship of the inheritors to the deceased person. Inheritance taxes in Iowa will decrease by 20 per year from 2021 through 2024.

Iowa Estate Tax Everything You Need To Know Smartasset

Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020.

. Probate Form for use by Iowa probate attorneys only. Land protection may reduce the value of your land which in turn reduces the value of your estate and may reduce your federal estate tax and state inheritance tax. IA 8864 Biodiesel Blended Fuel Tax Credit 41-149.

There is no federal inheritance tax but there is a federal estate tax. Read more about IA 8864 Biodiesel Blended Fuel Tax Credit 41-149. Even if an extension is granted on the return the tax payment is still due nine months after death.

Inheritance taxes in contrast are only levied on the value of assets transferred and are paid by the heirs. Starting with the 2021 tax year Iowa is repealing its state inheritance tax. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

Effective July 1 2021 for decedents dying on or after January 1 2021 but before January 1 2022 the applicable tax rates listed in Iowa Code section 450101-4 are reduced by 20. Iowa inheritance tax rates If you are the descendants brother sister half-brother half-sister son-in-law or daughter-in-law you will pay tax rates ranging from 4 on the first 12500 of inheritance up to 8 on the value of inheritances worth more than 150000. Ad Compare Your 2022 Tax Bracket vs.

Spouses children and even parents were already excluded from paying the inheritance tax while nieces. Iowa was one of just six states in the country to still impose an inheritance tax. The listed situations and the applicable tax rate range include.

In 2022 the tax rates listed below will be reduced by 40. Change or Cancel a Permit. Inheritance Tax Rates Schedule.

619 a law which will phase out inheritance taxes at a rate of 20 per year and completely eliminate the tax by January 1st 2025. From Fisher Investments 40 years managing money and helping thousands of families. Up to 25 cash back For deaths in 2021-2024 Iowa will reduce the estate tax rate by an additional 20 each year until the tax is fully phased out.

An Iowa inheritance tax return must be filed if estate assets pass to both an individual listed in Iowa Code section 4509 and that individuals spouse. Learn About Sales. Iowa has an inheritance tax but in 2021 the state decided it would repeal this tax by 2025.

In 2023 the tax rates below will be reduced by 60. Nieces nephews aunts uncles and all unrelated beneficiaries pay between 10 and 15 with all inheritances over 100000 facing the top rate. A summary of the different categories is as follows.

Especially if your total assets approach 5 million or more the possibility of being subject to estate tax rates as high as 40 percent can be a compelling reason to consider land. A business or other for-profit organization 200. This is scheduled to happen on Jan.

The applicable tax rates will be reduced an additional 20 for each of the following three years. In 2021 the tax rates listed below will be reduced by 20. However estates can be double-taxed if they fall under two jurisdictions that apply different taxes.

Inheritance Deferral of Tax 60-038. The first 500 of the total of all Masses specified in the Will is exempt from tax. Your 2021 Tax Bracket to See Whats Been Adjusted.

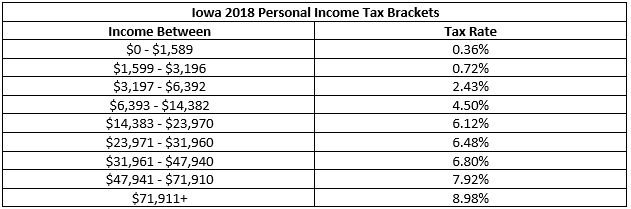

For deaths occurring on or after. Schedule B Beneficiaries. The tax rates applicable to inheritances that are subject to the Iowa inheritance tax vary.

Countries typically charge only estate or inheritance tax. With passage of the new bill if one were to pass away in 2021 the inheritance tax imposed on the inheritor would be reduced by 20 from the original rates. Ad Download Or Email IA 706 More Fillable Forms Register and Subscribe Now.

Those individuals that die on or after January 1 2021 also receive some reductions in the taxes but those dying after January 1 2025 get the full 100 reduction. 1 2025 with rates gradually decreasing over time. Track or File Rent Reimbursement.

Special tax rates apply to these organizations. Register for a Permit. Brothers and sisters of the deceased or a son-in-law or daughter-in-law 50 to 100.

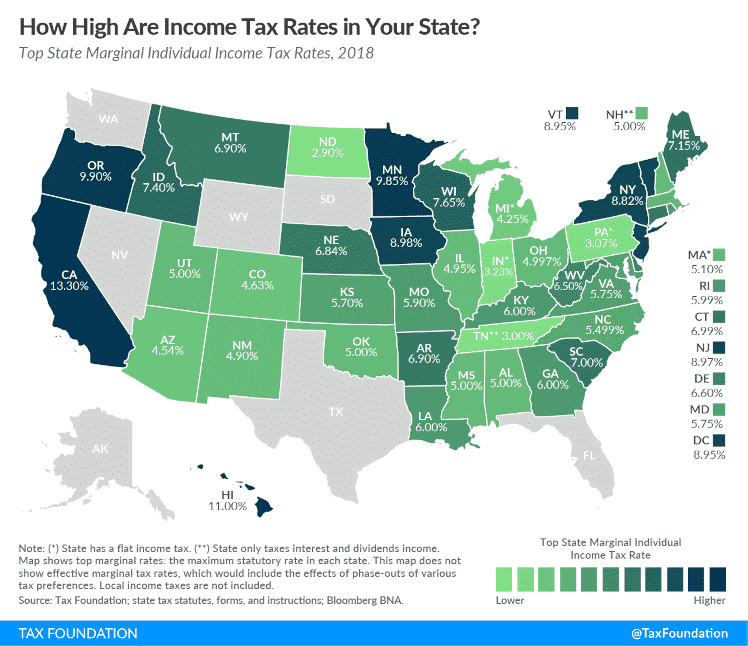

In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. 2021 taxiowagov 60-062 01032022 Pursuant to Iowa Code chapter 450 the tax rates are as follows. File a W-2 or 1099.

If the net value of the decedents estate is less than 25000 then no tax is applied. On May 19th 2021 the Iowa Legislature similarly passed SF. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40.

Discover Helpful Information and Resources on Taxes From AARP. It is phased in with reductions for the first few years but on January 1 2025 the Iowa Inheritance Tax will be fully repealed assuming Governor Reynolds signs the bill SF619. December 10 2021.

Gift taxes are levied when property is transferred by a living individual. Though you wont owe a state-level estate tax in Iowa the federal estate tax may apply. Ad Download Or Email IA 706 More Fillable Forms Register and Subscribe Now.

This is some text inside of a div block. And in 2024 the tax rates below will be reduced by 80. The federal estate tax exemption increased to 1170 million for deaths in 2021 and 1206 million for deaths in 2022.

As part of the reform bill Governor Reynolds signed into law on June 16 2021 Iowas inheritance tax will be phased out over four years. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Learn About Property Tax.

Unrelated individuals 100 to 150. Read more about Inheritance Tax Rates Schedule. Read more about Inheritance Deferral of Tax 60-038.

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

States With Highest And Lowest Sales Tax Rates

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

How Do State Estate And Inheritance Taxes Work Tax Policy Center

State Death Tax Hikes Loom Where Not To Die In 2021

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

How To Avoid Inheritance Tax In Iowa

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

How Is Tax Liability Calculated Common Tax Questions Answered

How Is Tax Liability Calculated Common Tax Questions Answered

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

States With No Estate Tax Or Inheritance Tax Plan Where You Die

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax